California State Owes Me Money

SCO: Home

Home Open FI$Cal data provides the public with the opportunity to explore how California’s tax dollars are at work for them. Currently, the site includes data from 147 departments, totaling 184 business units. This represents about 76% of California’s budgetary expenditures.

https://www.sco.ca.gov/

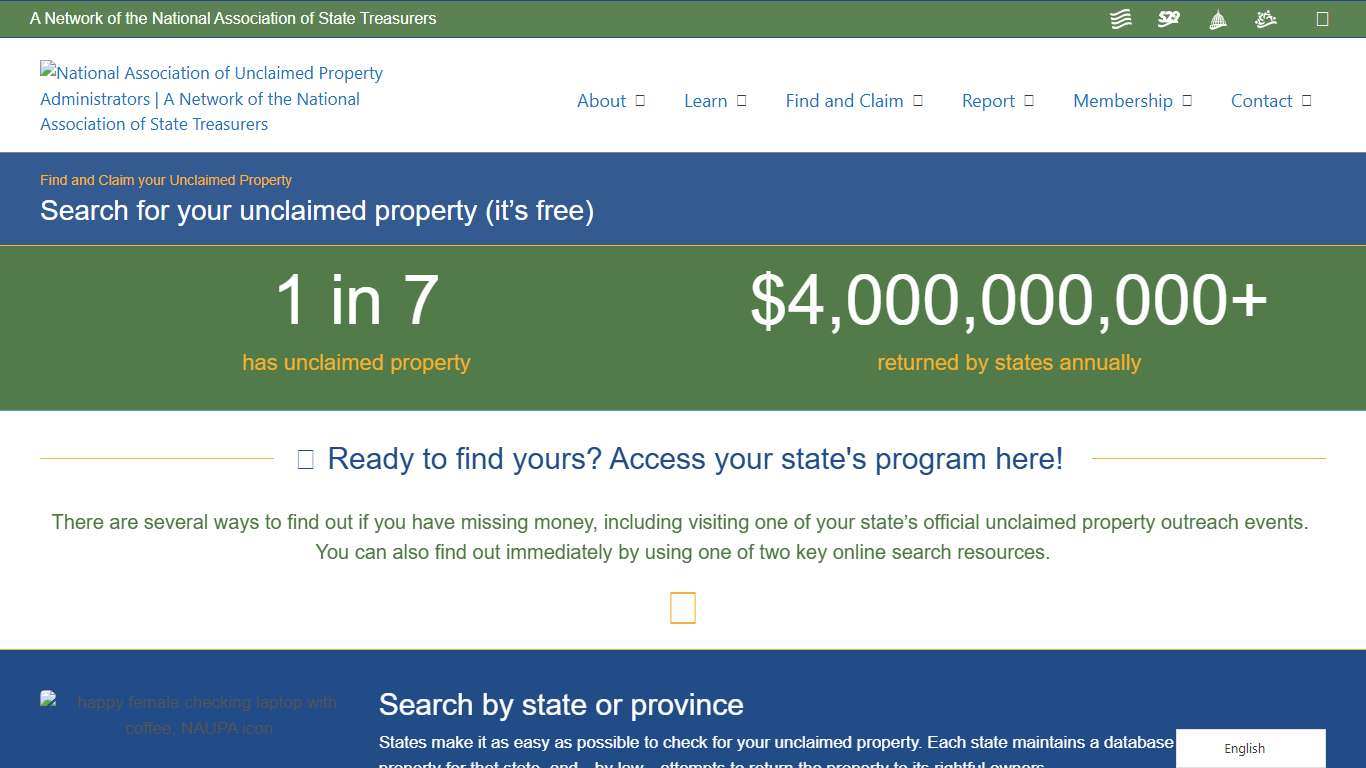

National Association of Unclaimed Property Administrators (NAUPA) – The leading, trusted authority in unclaimed property

NAUPA is the leading, trusted authority in unclaimed property. We help individuals claim their unclaimed property, and help businesses ensure compliance per state law in annual reporting. Search for property in your state or province Use the interactive map below or select from the list to find the official unclaimed property program for a state or province.

https://unclaimed.org/

Unclaimed property hot topics: Top 5 issues for 2026 Eversheds Sutherland (US) LLP - JDSupra

The unclaimed property landscape will continue to evolve rapidly in 2026. States are modifying their enforcement methods and broadening the reach of their statutes while simultaneously facing increased legal challenges from aggrieved property owners. 1. The proliferation of self-review “invitations” as an initial step for regulatory enforcement The methods state regulators use to enforce unclaimed property laws continue to transform and expand.

https://www.jdsupra.com/legalnews/unclaimed-property-hot-topics-top-5-5112801/

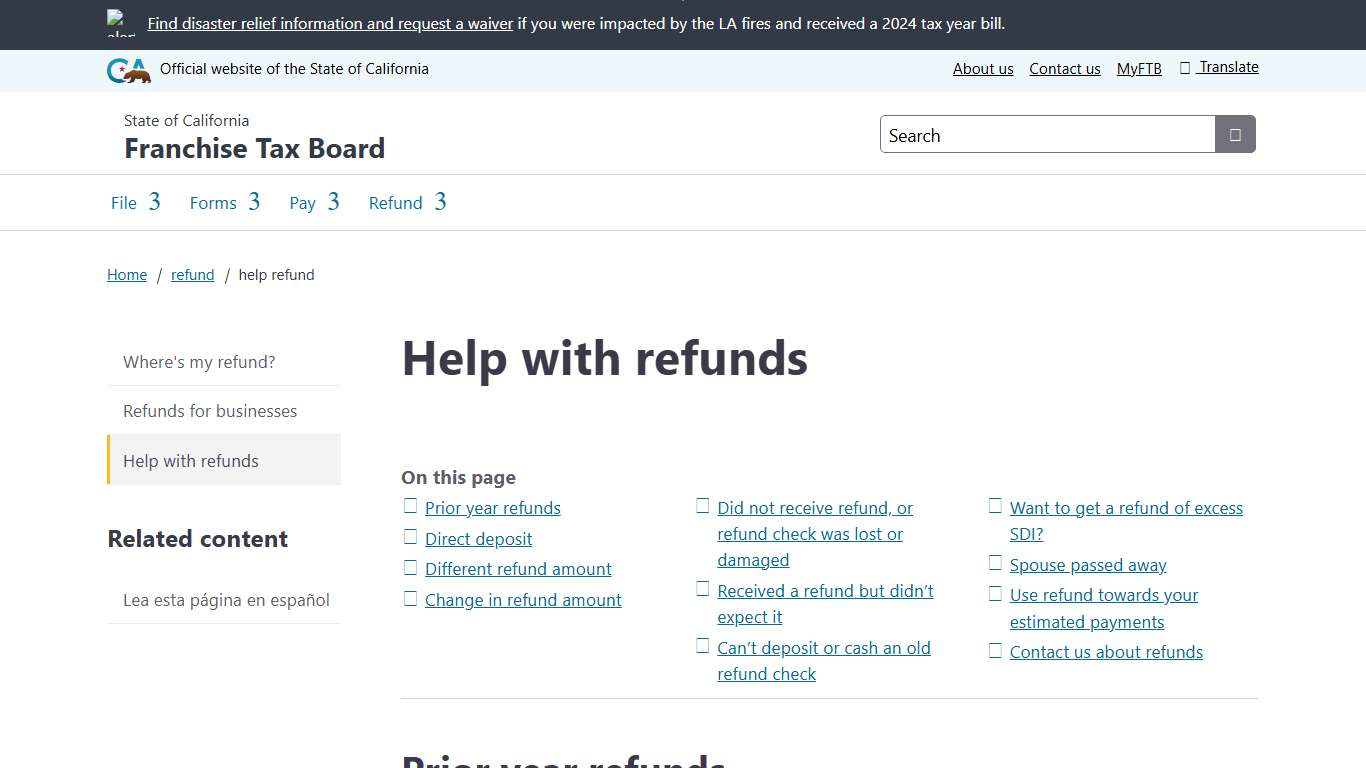

Help with refunds FTB.ca.gov

Help with refunds Prior year refunds You must contact us to check the status of a prior year tax refund. Direct deposit Direct deposit is the fastest way to get your tax refund. Setup direct deposit Choose direct deposit to receive your refund into your bank account.

https://www.ftb.ca.gov/refund/help-refund.html

Search for your unclaimed property (it’s free) – National Association of Unclaimed Property Administrators (NAUPA)

Ready to find yours? Access your state's program here! There are several ways to find out if you have missing money, including visiting one of your state’s official unclaimed property outreach events. You can also find out immediately by using one of two key online search resources.

https://unclaimed.org/search/

Important Changes

Updated Dec. 31, 2025 Federal Changes to Your Health Insurance New federal rule changes may affect your health insurance through Affordable Care Act marketplaces like Covered California. These could increase costs and create additional steps to enroll. We’ll keep you updated, but here’s what you can do now.

https://www.coveredca.com/important-changes/

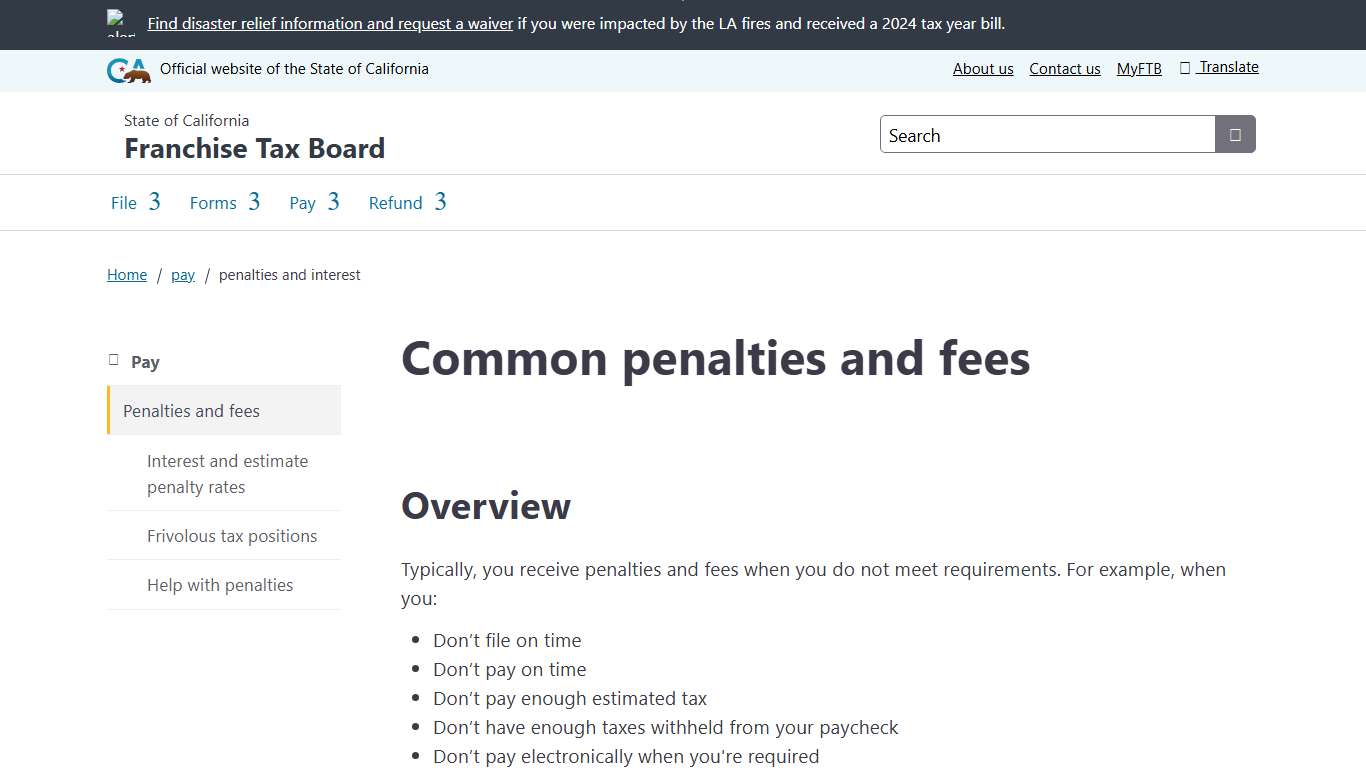

Common penalties and fees FTB.ca.gov

Common penalties and fees Overview Typically, you receive penalties and fees when you do not meet requirements. For example, when you: - Don’t file on time - Don’t pay on time - Don’t pay enough estimated tax - Don’t have enough taxes withheld from your paycheck - Don’t pay electronically when you're required - Make a dishonored payment (bounced check, insufficient funds) These are our most common penalties and fees.

https://www.ftb.ca.gov/pay/penalties-and-interest/index.html

Bill Text: CA AB885 2025-2026 Regular Session Amended LegiScan

Bill Text: CA AB885 | 2025-2026 | Regular Session | Amended Bill Title: Public postsecondary education: College Access for All Fund. Spectrum: Partisan Bill (Democrat 1) Status: (Introduced) 2025-05-23 - In committee: Held under submission. [AB885 Detail] Download: California-2025-AB885-Amended.html LEGISLATIVE COUNSEL'S DIGEST This bill would state the intent of the Legislature to enact subsequent legislation authorizing a revenue measure to ...

https://legiscan.com/CA/text/AB885/id/3186994

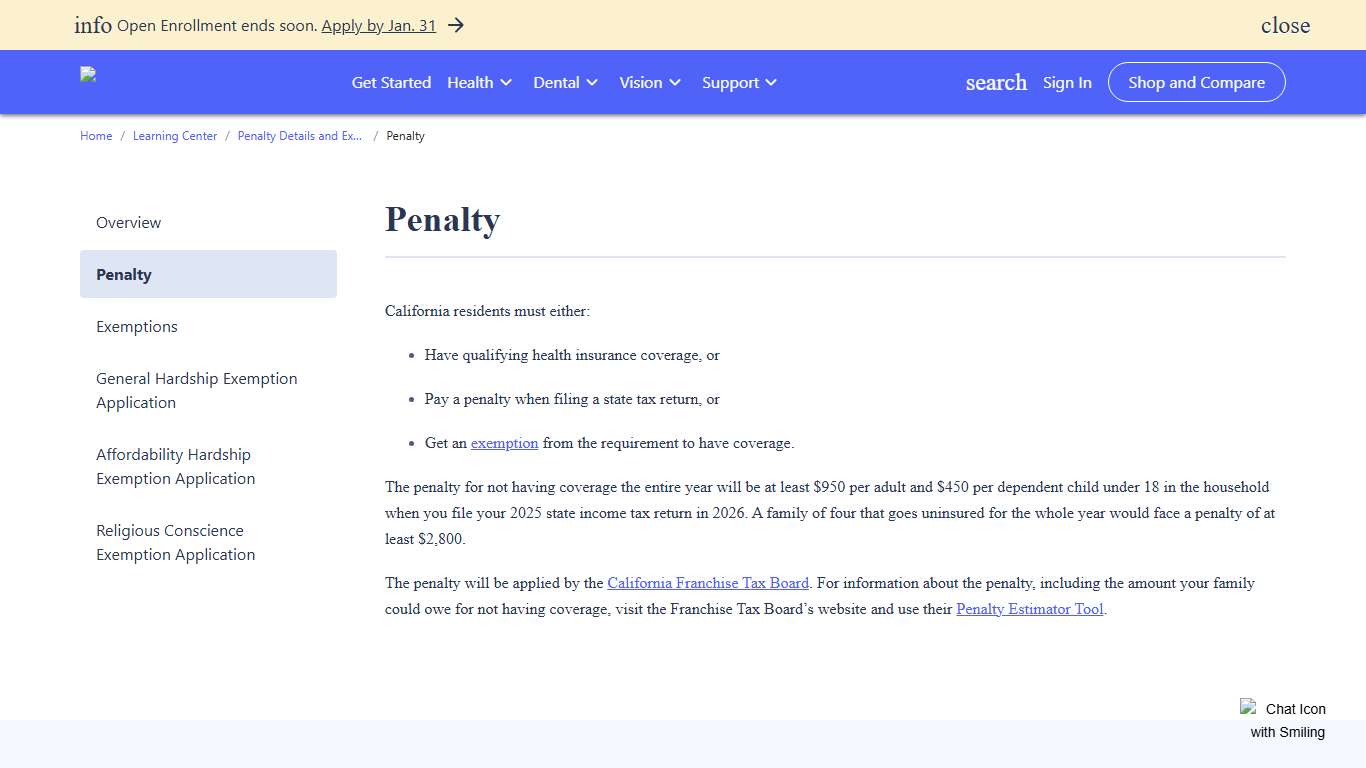

Penalty Covered California™

Penalty California residents must either: - Have qualifying health insurance coverage, or - Pay a penalty when filing a state tax return, or - Get an exemption from the requirement to have coverage. The penalty for not having coverage the entire year will be at least $950 per adult and $450 per dependent child under 18 in the household when you file your 2025 state income tax return in 2026.

https://www.coveredca.com/learning-center/tax-penalty-details-and-exemptions/penalty/

American Job Center Finder CareerOneStop

Get help finding your local American Job Center to apply for assistance and services...

https://www.careeronestop.org/LocalHelp/AmericanJobCenters/find-american-job-centers.aspx

Blue Cross and Blue Shield Nationwide Health Insurance bcbs.com Blue Cross Blue Shield

We're committed to making health care insurance easy, affordable and attainable for all. We offer affordable, high-quality health insurance solutions for individuals, families and employers. We're committed to making health care insurance easy, affordable and attainable for all. We offer affordable, high-quality health insurance solutions for individuals, families and employers.

https://www.bcbs.com/

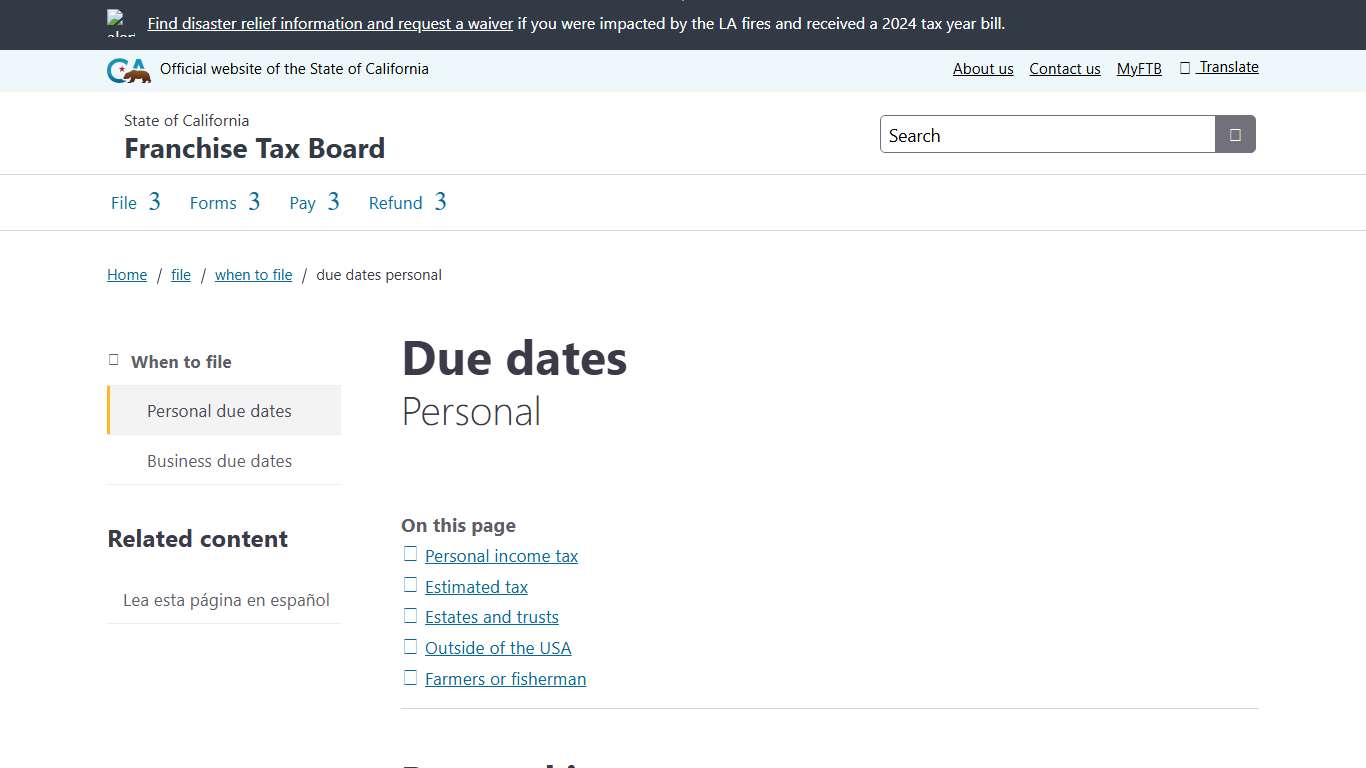

Due dates: personal FTB.ca.gov

Due dates Personal Personal income tax The due date to file your California state tax return and pay any balance due is April 15, 2026. However, California grants an automatic extension until October 15, 2026 to file your return, although your payment is still due by April 15, 2026.

https://www.ftb.ca.gov/file/when-to-file/due-dates-personal.html

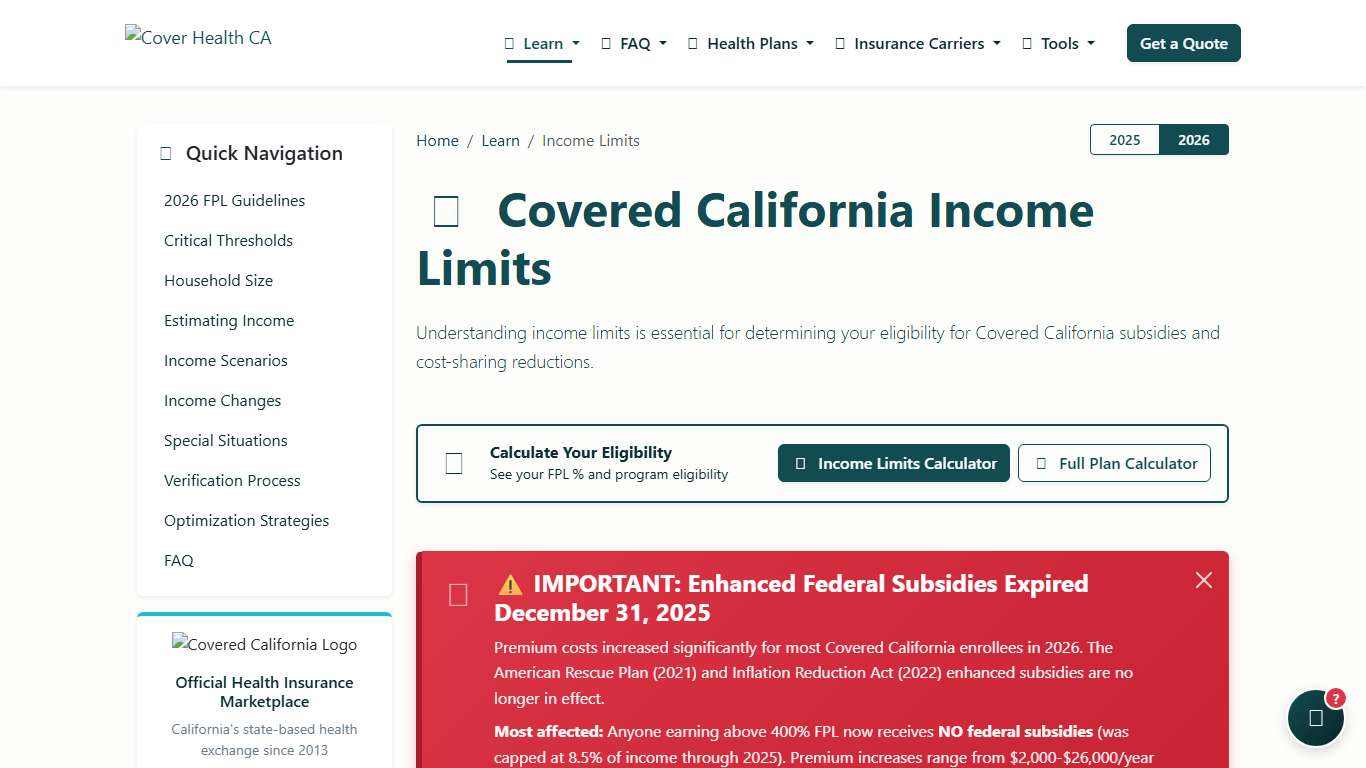

Covered California Income Limits - Federal Poverty Level Guidelines - Cover Health CA

Q: What if my income is right at a threshold (like exactly 150% FPL)? A: If you're at or below the threshold, you qualify for the benefits. For example, at exactly 150% FPL, you get $0 premiums. At 150.1% FPL, you'd pay a small amount.

https://www.coverhealthca.com/learn/income-limits?year=2026

Home Office of the Treasurer-Tax Collector, Riverside County, California

My staff and I are dedicated to improving your online experience to better help you find pertinent information. This would include online payments and tax status, important dates, upcoming tax sales, news and office hours and locations. On behalf of the County of Riverside, we thank you for your timely payment of property taxes.

https://countytreasurer.org/